How To Increase Retail Sales: 2024 Trend Report

Digitality for Direct Selling: How Tech Targets KPIs

Direct selling companies in 2023 face an inflection point. A multitude of macroeconomic challenges are compounding industry-specific issues that have been plaguing DS for years. With year one retention at 20% and 70-80% of new distributors not moving past sign-up according to the Direct Selling Association, whether DS companies can survive in the new normal is an open question.

What’s prevented the industry from keeping up thus far? Most DS-specific problems can be traced back to the incoherence of manual processes for things like onboarding, training, and communications, exacerbated by ineffective training for direct sales reps.

To prove that direct selling is a lasting and viable business model, DS companies must embrace digitality and transform their businesses with technology that targets KPIs. Simply put, many direct selling companies have failed to embrace digital transformation, missed opportunities for upskilling the workforce, and are now paying the price in their KPIs.

How Does Technology Target KPIs in Direct Selling?

Tech targets KPIs in direct selling by aligning corporate strategy with distributor enablement as it simultaneously reduces operational overhead by consolidating and centralizing resources.

Beyond the administrative havoc of siloed, manual management, DS companies that haven’t embraced digitality have no way of tracking or connecting individual processes like onboarding, training, and sales enablement with corporate KPIs. This is a costly mistake.

To build businesses capable of thriving in today’s business climate, the right technology to solve this problem is crucial. The benefits of embracing digitality in direct selling touch every corner of the business, optimizing the experience for leaders, distributors, and customers.

Why Direct Selling Companies Must Embrace Digitality

1. Technology optimizes distributor engagement for sustained productivity.

As self-driven enterprises without a conventional corporate, top-down accountability structure to ensure the delivery of work, engagement is a primary KPI for direct selling businesses. But engagement, of course, comes down to more than carrot-and-stick motivation. One of the primary reasons DS companies fall behind is they lack a science-backed technology to motivate and on-ramp their distributors, or to sustain their growth over time.

The right technology targets engagement KPIs by creating a holistic experience that accounts for all the levers which impact distributor attention and motivation over time. Market leading companies like Tupperware, for example, use the performance enablement framework to supercharge engagement from Day 1 by conceptualizing engagement as a journey rather than simply a metric.

When Tupperware decided to embrace digitality, leadership knew they wanted to create a personalized distributor journey for new consultants to feel successful quickly and generate the momentum to keep going. More than just shortening the time to first sale, Tupperware wanted to create a consultant experience that reflected the needs and goals of each individual to sustain engagement in the long term.

With Rallyware’s performance enablement platform, Tupperware was able to implement a number of strategies to boost engagement. Incentivizing onboarding was one of the first changes they made to improve this KPI, but, crucially not for its own sake.

That is, a 1.0 approach to digitalizing onboarding would be moving the process online and rewarding distributors in some way to finish. But Tupperware leadership understood that completion for its own sake doesn’t generate meaningful improvements for engagement in long-term business building. The goal was not to get new consultants simply to complete onboarding, but to generate motivation to move past onboarding.

This mindset is vital for digitality to transform KPIs in direct selling. The right technology doesn’t simply automate processes which reproduce the dynamics of the analog version online but reimagines them as a connected ecosystem, and enriches each part of this system with data to personalize each consultant’s ongoing journey.

Another component of Tupperware’s approach to engagement that sustains productivity is the gamification of training for the direct sales workforce. Making non-game activities more enjoyable and rewarding for distributors by incorporating elements such as points, badges, and leaderboards makes intuitive sense, but the difference in the performance enablement approach is again in connection to corporate KPIs.

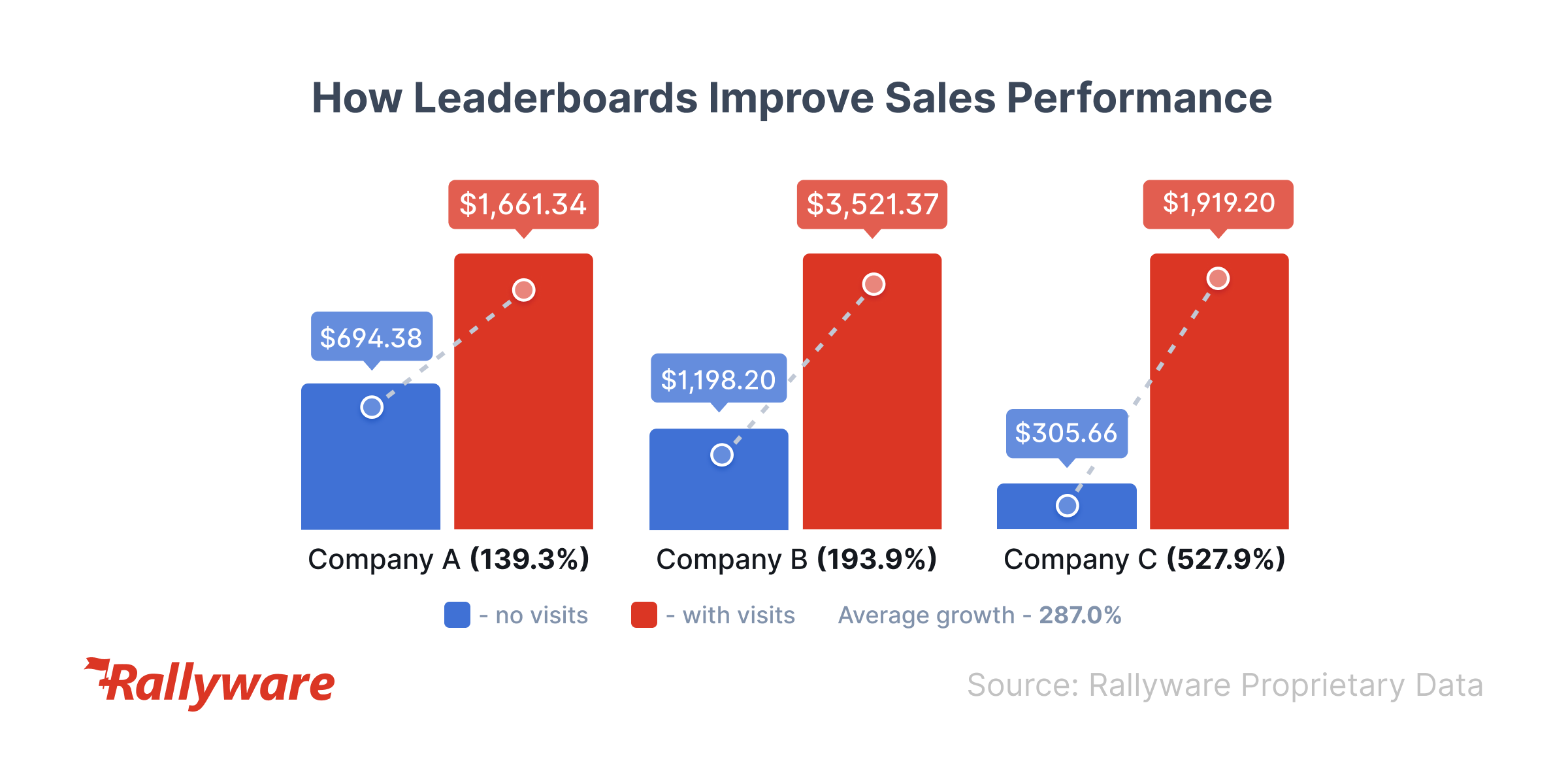

Rather than implementing gamification for its own sake, all gamified features on the Rallyware platform are designed to enhance the efficacy of training for direct sales reps to drive productivity. Proprietary Rallyware internal data shows the tremendous impact of gamification on sales productivity.

The average increases in sales for users versus non-users of leaderboards is as high as 527%, while users versus non users of badges see average sales growth of over 400%.

2. Technology centralizes resources to maximize the business value of training + reduce operating costs.

Reducing operational costs is top of mind for direct selling leaders right now, for good reason. As many in the industry struggle to remain competitive, bleeding budget on maintaining legacy systems that don’t actually improve KPIs is more dangerous than ever.

While maintaining tech stacks is operationally expensive, it also impacts KPIs on the distributor side, as consultants struggle to navigate multiple informational channels and apps. In this market, direct selling companies don’t need consultants to be spending precious time looking for resources when they could be using it to drive their businesses.

The industry term for companies that prioritize maintaining legacy systems over innovation is “legacy laggards” and the potentially disastrous consequences of this approach include bankruptcy at worst and huge operational inefficiencies at best.

Again, there’s a version of embracing digitality in consolidation efforts that offers a 1.0 improvement. In this version, the benefits of consolidation end at centralization.

In the next generation digitality, however, as in the Tupperware example above, consolidation creates connectivity and opens the flow of data between processes, enriching each one with purpose.

Legendary beauty brand Avon came to Rallyware looking for a training solution that would not only consolidate resources but deliver training materials that were more easily consumable and immediately applicable for new representatives.

While existing materials existed, they were not optimized for consumption by busy individuals new to direct selling. Rallyware used proprietary algorithms to revamp and restructure New Avon’s training resources to provide a more guided and manageable training experience for representatives, beginning with the Shortcut to Success onboarding program.

Features like data-driven gamification and just-in-time microlearning ensured both engagement and relevance while the Digital Library made it easier for new representatives to access and choose what they wanted to learn.

Key insight: By personalizing the experience in addition to centralizing it, performance enablement technology allows downlines to focus on business building while uplines can focus on more strategic initiatives such as mentoring and recruiting.

Avon began to see positive results within the first six months of implementation. Representatives who completed the Shortcut to Success program saw an average increase of 88% in sales during their first 60 days with the company, while the average number of orders for those who completed the program was 124% higher than those who didn’t.

3. Technology meets the field where they want to be: autonomous, mobile, and empowered to build their businesses.

One of the lesser discussed macro issues facing direct selling companies is changes in generational psychology. The field is increasingly populated by Millennials and even Gen Z folks who grew up as digital natives, value autonomy, and expect their workplaces to be flexible and mobile.

Direct selling is actually uniquely suited for delivering on these expectations, as a self-driven business model. But many direct selling companies have failed to realize this natural alignment because lack of technology limits this natural autonomy rather than enhancing it.

DS companies who have refused to innovate and update their systems to meet the new field where they are continue to lose people to gig companies which automate autonomy with all-in-one digital platforms.

Performance enablement is a framework for the new generation of DS distributors. Rather than enforcing top-down hierarchies, performance enablement platforms (PEPs) generate smart recommendations using corporate KPIs, individual goals, and performance data from top distributors to personalize pathways to success.

This is an “autonomy-driven” model of digitality for direct selling which uses automation and data to meet distributors where they are and engages them in a self-directed journey connected to corporate KPIs.

The beauty of this solution is that everyone benefits; distributors are empowered and feel autonomous, while HQ maximizes business outcomes by creating sustained alignment between personal distributor goals and corporate KPIs.

To see how digitality can transform KPIs for your direct selling business, sign up for a demo.

News and Insights on Workforce Training & Engagement

We’re among top-notch eLearning and business engagement platforms recognized for effective training and talent development, helping to empower distributed workforces

Subscribe